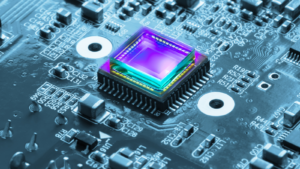

Semiconductors are essential components of many electronic devices, such as computers, smartphones, cars, and medical equipment. They are also critical for national security, as they enable advanced technologies such as artificial intelligence, quantum computing, and 5G networks. However, the U.S. has been losing its global leadership in semiconductor innovation and production, as other countries, especially China, have invested heavily in developing their own capabilities.

Semiconductors are essential components of many electronic devices, such as computers, smartphones, cars, and medical equipment. They are also critical for national security, as they enable advanced technologies such as artificial intelligence, quantum computing, and 5G networks. However, the U.S. has been losing its global leadership in semiconductor innovation and production, as other countries, especially China, have invested heavily in developing their own capabilities.

The CHIPS Act aims to reverse this trend by providing incentives and support for domestic semiconductor research and manufacturing. The law establishes three funds with a total of $52.7 billion in appropriations:

– The CHIPS for America Fund, which provides grants and tax credits for semiconductor manufacturing facilities and equipment in the U.S.

– The CHIPS for America Defense Fund, which supports the National Network for Microelectronics Research and Development, a consortium of federal agencies, industry partners, and academic institutions that conduct collaborative research on emerging semiconductor technologies.

– The CHIPS for America International Technology Security and Innovation Fund, which promotes international cooperation and security on information and communications technology issues, including semiconductors and telecommunications.

The CHIPS Act also prohibits funding recipients from expanding semiconductor manufacturing in China and countries defined by U.S. law as posing a national security threat to the U.S.

How does the CHIPS Act affect the construction industry?

The construction industry can benefit from the CHIPS Act in several ways. First, the act can create more demand for construction services, as semiconductor manufacturers may need to build new facilities or upgrade existing ones to take advantage of the incentives and grants provided by the law. Second, the act can improve the availability and affordability of semiconductors, which are used in many construction-related applications, such as smart buildings, sensors, robotics, drones, and autonomous vehicles. Third, the act can spur innovation and competitiveness in the construction industry, as new semiconductor technologies can enable more efficient, sustainable, and resilient construction processes and outcomes.

The construction industry can benefit from the CHIPS Act in several ways. First, the act can create more demand for construction services, as semiconductor manufacturers may need to build new facilities or upgrade existing ones to take advantage of the incentives and grants provided by the law. Second, the act can improve the availability and affordability of semiconductors, which are used in many construction-related applications, such as smart buildings, sensors, robotics, drones, and autonomous vehicles. Third, the act can spur innovation and competitiveness in the construction industry, as new semiconductor technologies can enable more efficient, sustainable, and resilient construction processes and outcomes.

What types of construction projects qualify for the tax incentives?

The tax incentives under the CHIPS Act are available for qualified investment property (QIP) used in semiconductor manufacturing or research activities in the U.S. QIP includes any tangible property that is depreciable under U.S. tax law and is used predominantly in one or more of the following activities:

– Fabricating or processing semiconductors

– Testing or inspecting semiconductors

– Packaging or assembling semiconductors

– Researching or developing semiconductors

QIP does not include any property that is used predominantly outside the U.S., leased to another person or entity, or subject to a binding contract to be acquired by another person or entity.

The tax incentives consist of a 25% investment tax credit (ITC) for QIP placed in service before January 1, 2027, and a 10% ITC for QIP placed in service after December 31, 2026 but before January 1, 2032. The ITC is claimed in the year that the QIP is placed in service and reduces the basis of the QIP by 50% of the amount of the credit. The ITC is subject to recapture if the QIP ceases to be used predominantly in semiconductor activities within five years after it is placed in service.

Therefore, any construction project that involves building or improving QIP used in semiconductor activities in the U.S. can qualify for the tax incentives under the CHIPS Act, as long as it meets the requirements and limitations described above.